Sofort Banking

1. Decomissioning

Decommissioning of Sofort Banking

- From 1 October 2025, this payment method will be decommissioned and deactivated in your PSPID (Configuration > Payment methods > Selected payment methods). No further postponements are planned.

- We will already deactivate Sofort Banking in our test environment as of 23 September 2025.

- To prevent declined transactions and ensure a seamless checkout experience for your customers, this payment method will disappear from the e-Commerce (HPP) selection screen.

- If you process HPP transactions using one or more of these parameters, make sure to exclude this payment method from your payment request:

PM

BRAND

PMLIST

EXCLPMLIST

Refer to the "Payment method selection options" section in our Hosted Payment Page guide for details. - Refund processing remains available until further notice.

- We are happy to support you with this transition. If you have any questions or need assistance in setting up an alternative, contact us.

2. Introduction

2.1 What to configure

At Sofort Banking, a configuration is known as a “Project”. Before you can use Sofort Banking, you will need to do the following:

- You must be registered and have a user ID and project on the Sofort website. The process for creating a project is described here.

- You must complete the Sofort Banking project details on the Sofort payment method configuration page in your Nexi Payengine back office. The configuration in your Nexi Payengine account is described here.

2.2 How to configure

You can configure the necessary steps either automatically or manually.

2.2.1 Automatic configuration

The configuration process is initiated in your Nexi Payengine back office on the Sofort payment method configuration page.

A Sofort Banking userID and projectID can be obtained automatically by clicking a button on the payment method configuration page in your Nexi Payengine back office. This way, most of the project details will be pre-configured by Nexi Payengine in the Sofort Banking website.

If you would like to create a configuration automatically, please see here.

2.2.2 Manual configuration

The configuration process is initiated on the Sofort Banking website.

You must first create your user and project manually on the Sofort Banking website and, after that, enter the necessary payment method configuration details in your Nexi Payengine account.

2.3 Test project/account

We have developed a Sofort Banking transaction simulator in the Nexi Payengine test environment. To perform Sofort Banking test transactions you can simply enable the Sofort Banking payment method in your Nexi Payengine test account. You do not need to configure anything on the Sofort Banking website.

2.4 IMPORTANT – Missing funds for status 9 transactions

There is a very low chance (between 1 to 2 % of all your Sofort transactions) that a successful Sofort transaction (status 9) will not be paid out to you eventually.

In these rare occasions, the customer’s bank account doesn’t have sufficient funds available at the specific time frame when bank transfer is effectively executed.

Would you have further questions about this, you can contact Sofort GmbH.

3. Nexi Payengine account configuration

The Sofort Banking payment method can be configured via the “Payment methods” link in the back office.

3.1 Configuration with automatic registration and/or project creation at Sofort Banking

If you have not yet created a project on the Sofort Banking website, you can create one automatically by clicking the “Obtain UserID and ProjectID for this Payment Method” button. You will then be redirected to the Sofort Banking website. Nexi Payengine provides most of the configuration information directly to Sofort Banking.

If you already have a Sofort Banking account, click the option “I have registered already for sofort.com” and a project will be created in your existing account.

If you have not yet registered for Sofort Banking, click the option “I am not a customer yet”. The system will then create a new account and a new project for you.

|

When you click the “Obtain UserID and ProjectID for this Payment Method” button in your Nexi Payengine TEST account, a TEST project will be created at Sofort Banking. When you click the “Obtain UserID and ProjectID for this Payment Method” button in your Nexi Payengine PROD account, a PROD project will be created at Sofort Banking. |

Once the project has been created and configured, you need to enter the project details (User_ID, Project_ID and Project password) in the Sofort Banking payment method configuration page.

3.2 Configuration after project creation at Sofort Banking

You must now enter the project details (User_ID, Project_ID and Project password) of the project you created on the Sofort Banking website.

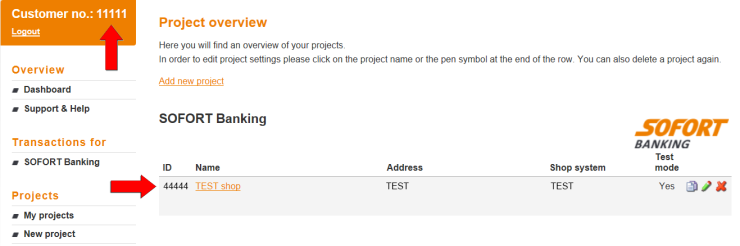

The User_ID and the Project_ID can be found in the project overview in your Sofort Banking account. In the example below the User_ID is “11111” and the Project_ID is “44444”.

You can find the Project password in the "Extended Settings" tab for your project > "Project Password and Input check".

Click (Activation) “Yes” and “Submit” in the Sofort Banking payment method configuration page in your Nexi Payengine account.

4. Sofort Project Configuration

To enter the Sofort Banking back office, go to https://www.sofort.com, click on “Merchant” and then "Login"complete your login details.

4.1 Create a project

- Click on “My Projects” in the Projects menu.

- Click on the “Add new project” link in the Project overview page.

- On the “Choose your project type” page, select "Create a SOFORT Classic project".

4.2 Basic settings

Remark: The notification password must not be set! If the notification password (Benachrichtigungskennwort) is set, it can be cleared on request by Sofort.

4.2.1 General settings

Enter a project name and select your payment solution provider (Nexi Payengine) in the “Shop system” drop down menu.

|

Important The “Testing Mode” checkbox should only be enabled if you wish to create a test project containing Nexi Payengine test URLs for use in your Nexi Payengine test account. If you are configuring a production project containing Nexi Payengine production URLs for your Nexi Payengine production account, please leave the “Testing mode” checkbox disabled! Do not mix test and prod projects, URLs and configurations as that would lead either to authentic transactions being generated in the test environment or authentic transactions being lost in prod. To avoid any errors, if you would like to carry out a test configuration, you need to create a separate project, i.e. you need to configure two projects at Sofort.com: a test project and a prod project. |

4.2.2 Interface

In the “Interface” section, you need to configure the following URLs:

Success link:

https://secure.payengine.de/ncol/prod/order_anetb_flowhandler_utf8.asp?op=success&TXID=-TRANSACTION-&PAYID=-USER_VARIABLE_0-&PM=-USER_VARIABLE_1-&HASHPSP=-USER_VARIABLE_2-&SIGN=-USER_VARIABLE_3_HASH_PASS-

Abort link:

https://secure.payengine.de/ncol/prod/order_anetb_flowhandler_utf8.asp?op=cancel&PAYID=-USER_VARIABLE_0-&PM=-USER_VARIABLE_1-&HASHPSP=-USER_VARIABLE_2-&SIGN=-USER_VARIABLE_4_HASH_PASS-

Enable the “Automatic redirection” checkbox. The “Show feedback page” checkbox is optional.

4.2.3 Other

Enter your details in the “Address”, “Common settings for Sofort.com” and “Bank account” sections.

Click on “Save” when you have finished your “Basic settings” configuration.

4.3 Extended settings

You need to configure some extended settings for your project via the Extended Settings tab.

4.3.1 Shop System Interface

On the “Shop system interface” page, you will see the Success and Abort links that you entered earlier in the “Interface” section of the Basic Settings tab, and an additional section, called Timeout.

Configure the value “900” for the Timeout in seconds.

Configure the following URL for the Timeout link:

https://secure.payengine.de/ncol/prod/order_anetb_flowhandler_utf8.asp?op=cancel&PAYID=-USER_VARIABLE_0-&PM=-USER_VARIABLE_1-&HASHPSP=-USER_VARIABLE_2-

Enable the “Skip first steps” checkbox in the “Skip steps” section.

Click on “Save” when you have finished your “Shop System Interface” configuration.

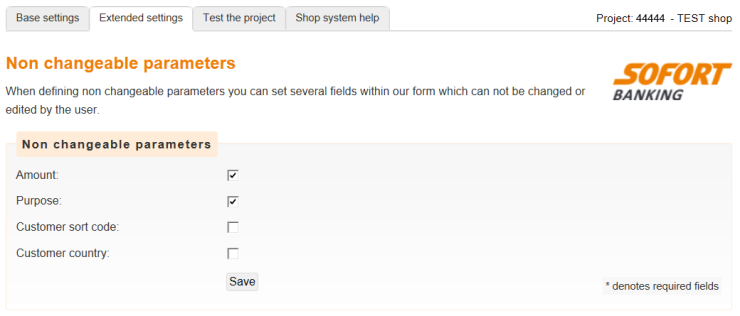

4.3.2 Nonchangeable parameters

Configure the nonchangeable parameters as follows and click "Save":

4.3.3 Notifications

In the Notifications page there are two types of notifications: email and HTTP.

You can add new/additional notifications by clicking the "Add new notification" link.

Enter your e-mail address in the "E-mail" field, select your language, enable the "activated" checkbox and click "Save".

HTTP

Enter the URL in the “Notification URL” field, enable the “activated” checkbox and click “Save”.

HTTP Notification URL: https://secure.payengine.de/ncol/prod/Order_AnetB_Direct_utf8.asp?op=serverserver

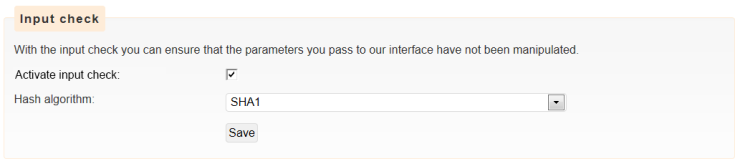

4.3.4 Project password and input check

Choose a password, and complete the "Input Check" as shown below.

The password chosen here is the one you need to enter in the "Project password" field in the Sofort Banking payment method configuration page in your Nexi Payengine back office.

Questions fréquemment posées

Le délai d’activation des méthodes de paiement dépend des facteurs suivants :

- Il faut généralement compter une semaine pour qu’un acquéreur ou une banque valide l’affiliation. Si vous êtes déjà affilié, l’activation ne prendra que quelques jours.

- Certaines méthodes de paiement nécessitent des vérifications supplémentaires avant de pouvoir les activer. C’est le cas de 3-D Secure, qui est demandé directement auprès de VISA ou de MasterCard (et non de l’acquéreur).