Przelewy24

1. Introduction

P24 is an online banking payment (bank transfer) method that enables your customers in e-commerce to make an online purchase via their online banking service; both via computer and on a mobile (web optimized). P24 covers over 35 banks in Poland, including all major ones and is as such one of the leading payment methods of its kind in the Polish market.

Over 80% of all Polish consumers have a preference for this form of payment. So without a doubt this payment method will help you, as a merchant selling to the Polish market, increase your conversion rates.

P24 is offered by Nexi Payengine as a webbanking payment method, meaning with redirection from the hosted payment page (e-Commerce) to the P24 environment. This way P24 is also a payment method with "guaranteed" payments.

2. Activation and configuration

After registering with Przelewy24, they will provide you with a Merchant ID, CRC key and WebService key. In your Nexi Payengine account, P24 will be added, configured and activated by Nexi Payengine Support, using these credentials.

Please contact your Sales representative should you require more information.

3. Payment flow

A typical payment with P24 via Nexi Payengine goes as follows:

- The customer selects P24 on the Nexi Payengine hosted payment page or pre-selected via your own payment method selection page.

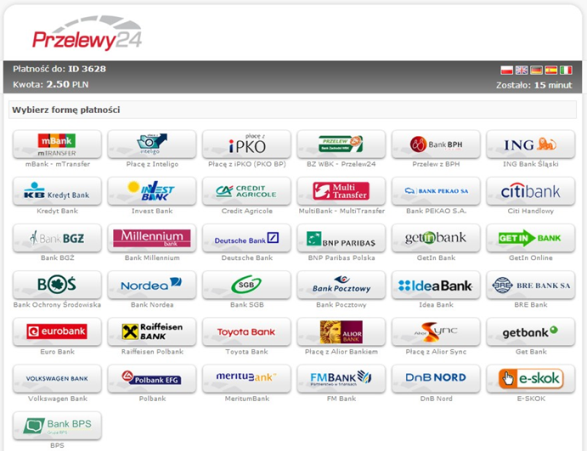

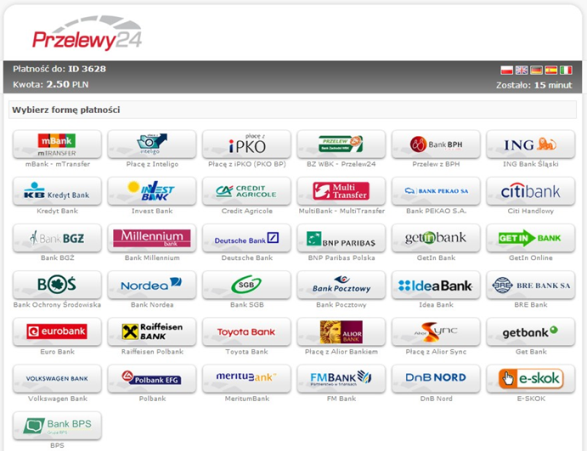

- The customer is then redirected to the P24 page and chooses his preferred online bank.

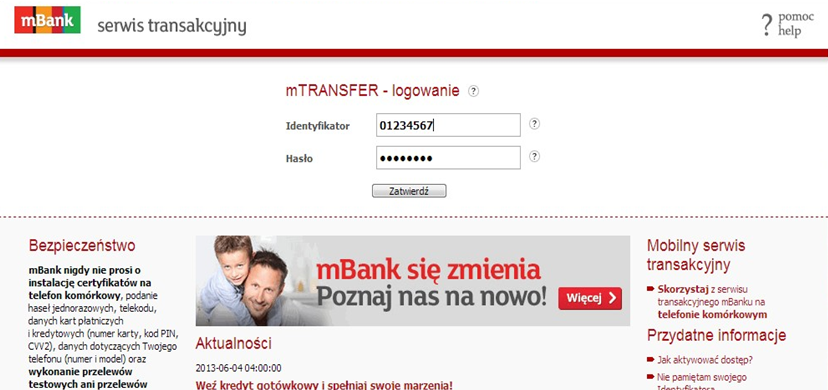

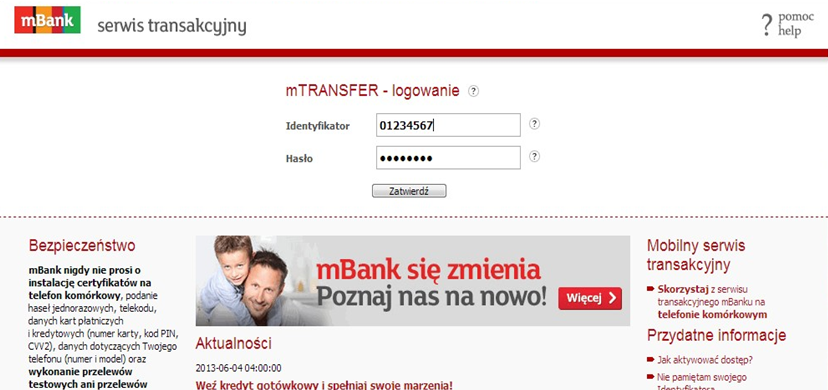

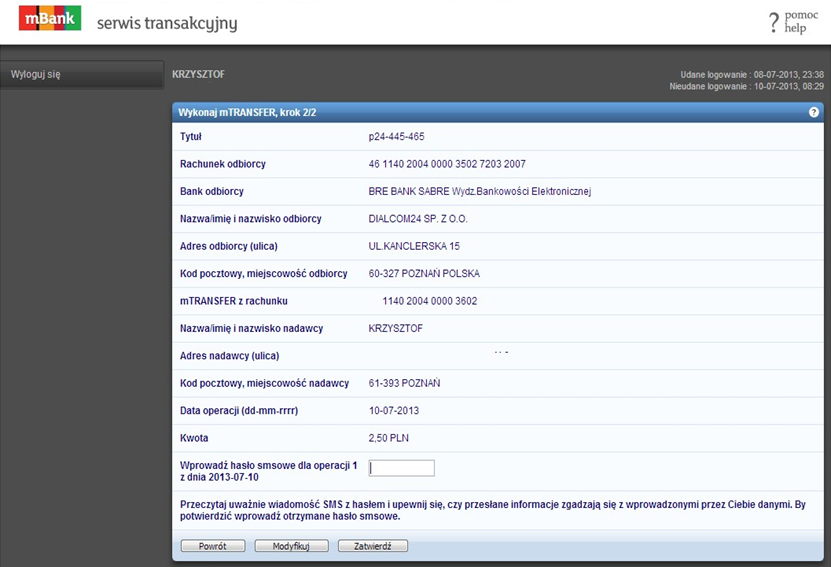

- After clicking his bank’s icon the customer is automatically redirected to the bank, where he has to log on.

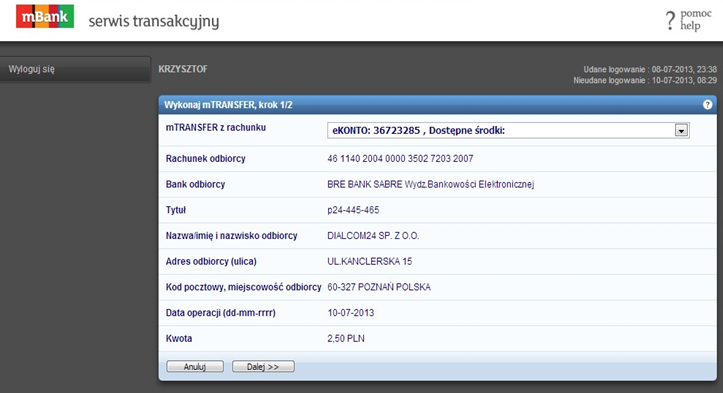

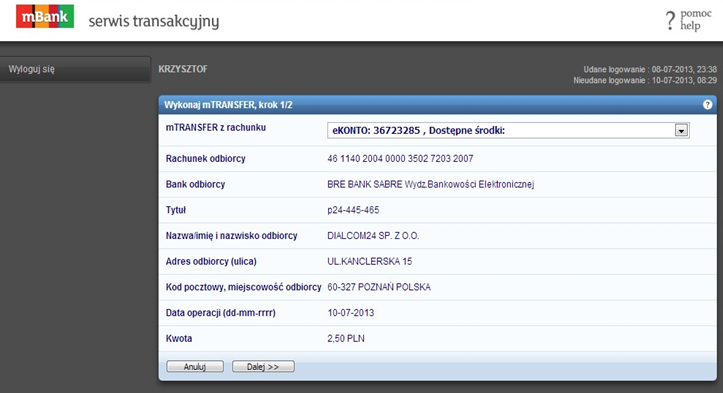

- A bank transfer form is automatically filled in. After verifying his details the customer can then accept the transfer.

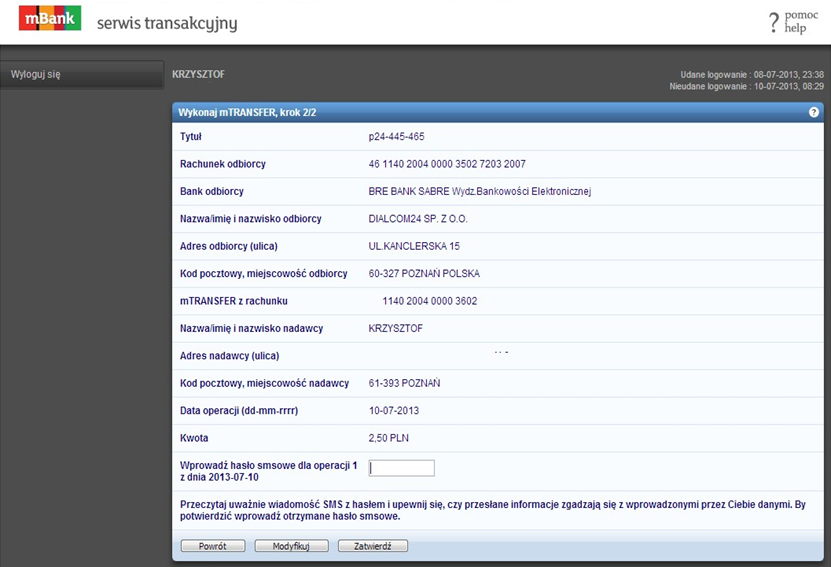

- The customer is asked to enter an activation code from his bank (in the example an SMS code).

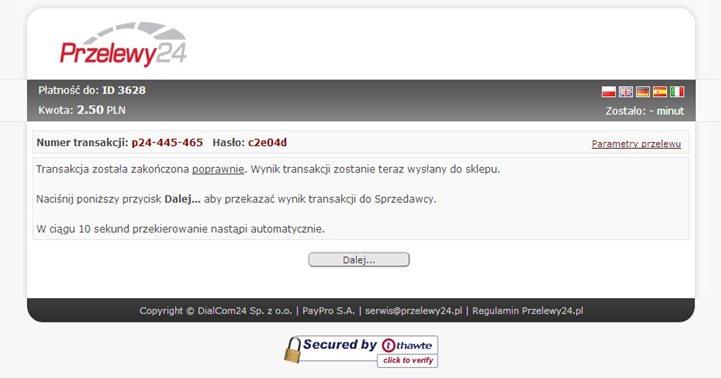

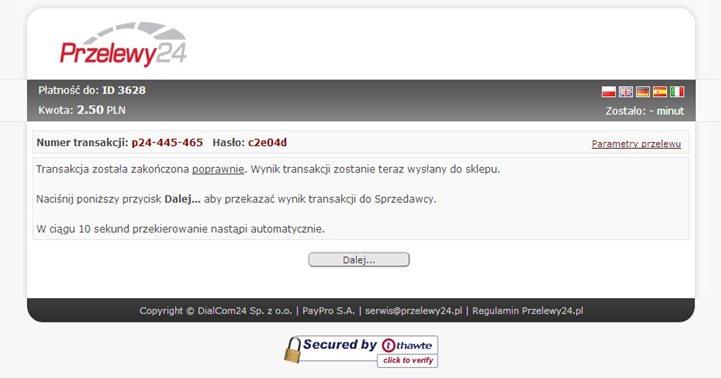

- Then the customer returns to Przelewy24 with the confirmation that the transfer is OK (this can also be the Nexi Payengine confirmation page). Hereafter the customer is automatically redirected to merchant’s site.

4. Integration

P24 must only be integrated with the Nexi Payengine hosted payment page.

Please check our dedicated e-Commerce documentation for more information.

4.1 Payment method selection

If you let your customers choose Przelewy24 directly on our hosted payment page (as opposed to a selection page of your own), no further integration is required; the payment method (once activated) will be visible on the payment page.

In the event you've created a payment method selection page of your own, by which your customers are redirected from your page directly to the hosted payment page with the payment method preselected, you're making use of the PM and BRAND parameters.

To call the Przelewy24 payment page directly, the following PM and BRAND values must be used:

| Field | Value |

|---|---|

| PM | Przelewy24 |

| BRAND | Przelewy24 |

The same values are returned in the redirection and post-sale feedback.

4.2 Testing

To perform tests (end to end) with P24 in your Nexi Payengine test account, you must obtain the following test credentials from P24 (similar to the ones used in production):

- Merchant ID

- CRC key

- WebService key

You must provide us with these details, so we can enable your test account for end-to-end testing.

The payment flow, interface etc. are the same as in production.

5. Status flow and recovery

By default, in case of a successful payment, the final transaction status 9-Payment requested will immediately be given.

It is possible however that, for specific reasons, our platform is not able to retrieve the outcome of the payment immediately. In this case a transaction can get any of the following statuses:

| Status | Reason |

|---|---|

| 0 | We received no response from P24 |

| 51 | We received an error code from P24 (e.g. because the customer closed his browser too soon) |

| 92 | Our platform was not able to verify the response from P24 |

In all of these cases our platform will try to recover the final status several times:

- In the first 2 days, every 15 minutes (starting 15 minutes after the order).

- After two days, once per day until 30 days after the original order time.

If the transaction remains uncertain after 30 days, it will automatically be denied and go to status 2-Authorisation denied.

6. Reporting

In your online transaction overviews and transaction report downloads (View transactions / Financial history), P24 transactions will be indicated with "Przelewy24". In case of downloaded reports, this is indicated in the METHOD and BRAND columns.

7. Transaction maintenance

P24 is a "direct" payment method, meaning the payment is handled in one step, never in two steps (=authorisation + data capture).

Refunds, both full and partial, are supported (cf. Refund a payment).

FAQs

The time to activate a payment method depends on the following factors:

- It generally takes the acquirer or bank about a week to complete your affiliation. If you already have an affiliation, the activation takes a few days.

- Some payment methods require additional checks before they can be activated, e.g. in case of 3-D Secure, which is requested directly at VISA or MasterCard (and not at the acquirer).