Fraud Detection Module

1. Introduction

The online payment landscape can be complex. Today, businesses need to move quickly to stay one step ahead of fraudsters. That’s why Nexi Payengine has the perfect solution for you. Boost your business line of defense with our Fraud Detection Module (FDM). How? We offer you a flexible range of features that you can customise to suit your needs.

For example, you can:

- Block transactions by IP addresses or by location from where the cards were issued

- Control and configure how 3-D Secure (3DS) transactions are handled if and when they go wrong

- Easily set minimum and maximum limits per transaction, per card and/or per period

Fight off fraudulent transactions in real-time and accept payment with confidence. Use our Fraud Detection Module today.

2. Before we begin

At the end of the guide, you will be able to do configure your 3-D Secure (also known as 3DS) settings of your payment methods, manage and set conditions for your transactions.

To get started, make sure that your FDM (ID: CAP) is activated. You can do this by going to Configuration > Account > Your options in your account.

3. Manage 3DS settings

3-D Secure (3DS) is an anti-fraud protocol designed to enhance security for both you and your customers. Learn more about 3DS in our FAQ.

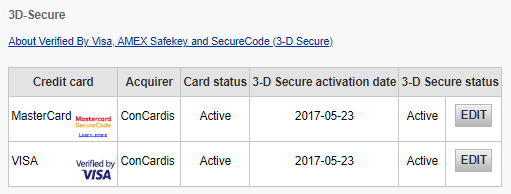

Manage 3DS settings

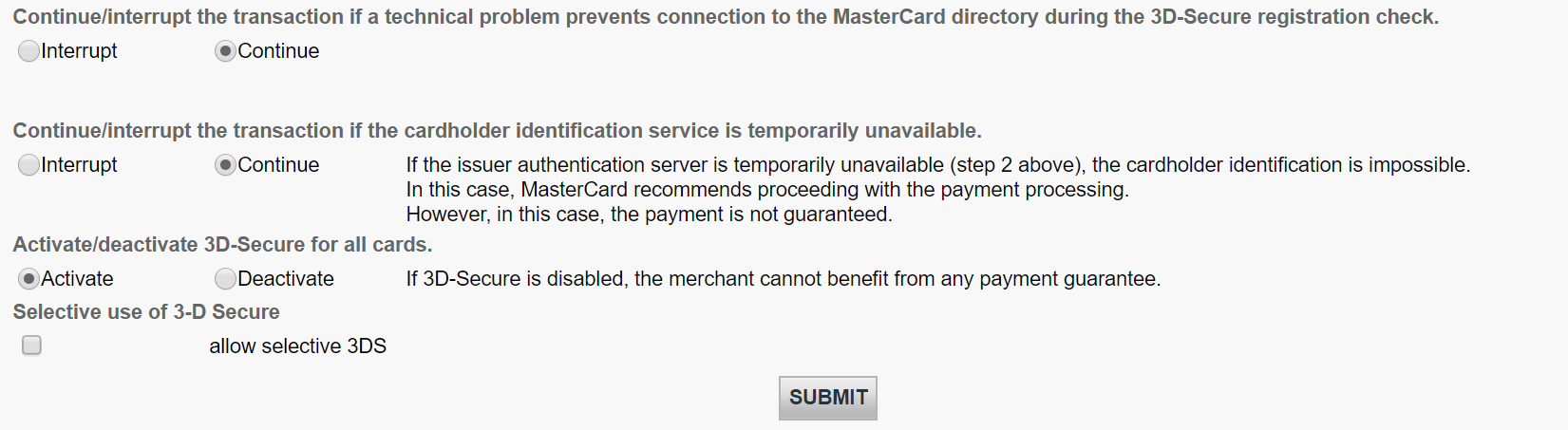

Once your fraud subscription is active, you can now configure your 3DS settings. Go to Advanced > Fraud Detection. 3DS will have to be configured individually for each payment method. Under 3-D Secure, select a payment method by clicking on EDIT. You will see a list of actions that you can choose from.

The table below provides an overview on actions listed on the page and what they mean.

| Actions | Explanation |

|---|---|

|

You can either continue or interrupt the transaction if a technical problem prevents connection to the respective acquirer during the 3D-Secure registration check. |

You may want to do configure this option in case we cannot connect to the 3DS directory of the related scheme/card brand. |

|

You can either continue or interrupt the transaction if the cardholder identification service is temporarily unavailable. |

You may want to configure this option in case the 3DS verification URL is not working. |

|

You can either activate or deactivate 3D-Secure for all cards.

|

If you decide to deactivate 3DS, it will not be rolled out at all. |

|

You can process 3D-Secure depending on the Global Fraud Score. |

3DS will be processed based on your fraud settings and our Fraud Expert assessment if it has been activated. |

4. Set conditions for Merchant Fraud lists

Merchant Fraud lists are lists that allow you to set conditions for your payments. For example, you may want to block illegitimate transactions based on their IP addresses or even the card’s country of issue! In this chapter, you will learn how to manage these lists.

There are two types of lists.

- Whitelists allow you set conditions for when a transaction should be accepted.

- Blacklists allow you to set conditions for when a transaction should be blocked.

View lists

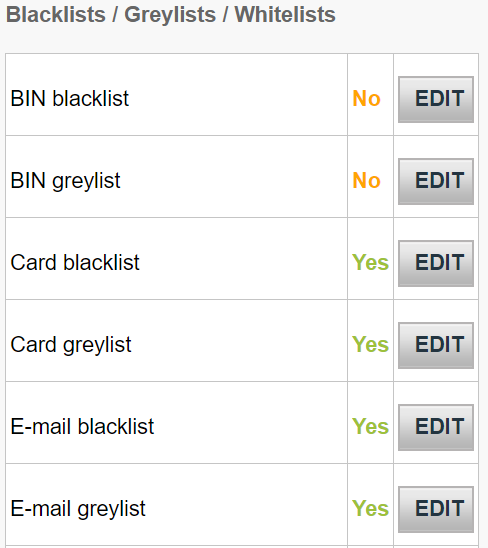

View these lists by going to Advanced > Fraud Detection in your account. Under Blacklist / Greylist / Whitelist, select an item that you would like to configure and click EDIT.

Manage lists

If a transaction matches any of the conditions that you have set on these lists, it will be then accepted or blocked accordingly.

Depending on the action that you choose to take, you might also need to send some parameters to our platform. Below is an overview of the list types (which are conditions you can set), what they mean and parameters that would need to be sent.

| List type | Explanation | Parameters to be sent |

|---|---|---|

|

Card blacklist |

You will need the full credit card. For Direct debits, you will need the full bank account. |

CARDNO |

|

|

A Bank Identification Number (BIN) consists of the first six digits of a credit card linked to an issuer in a specific country. This allows you to block all credit cards that share the same BIN

|

CARDNO |

|

IP blacklist |

Our system will accept both specific IPs or IP ranges according to the formatting a.b.c-d.0-255 or a.b.c-d.* or a.b.c.d-e.

|

REMOTE_ADDR |

|

IP address whitelist |

Our system will accept both specific IPs or IP ranges according to the formatting a.b.c-d.0-255 or a.b.c-d.* or a.b.c.d-e.

|

REMOTE_ADDR (For Directlink, this is the buyer’s IP address) |

Add new items to a list

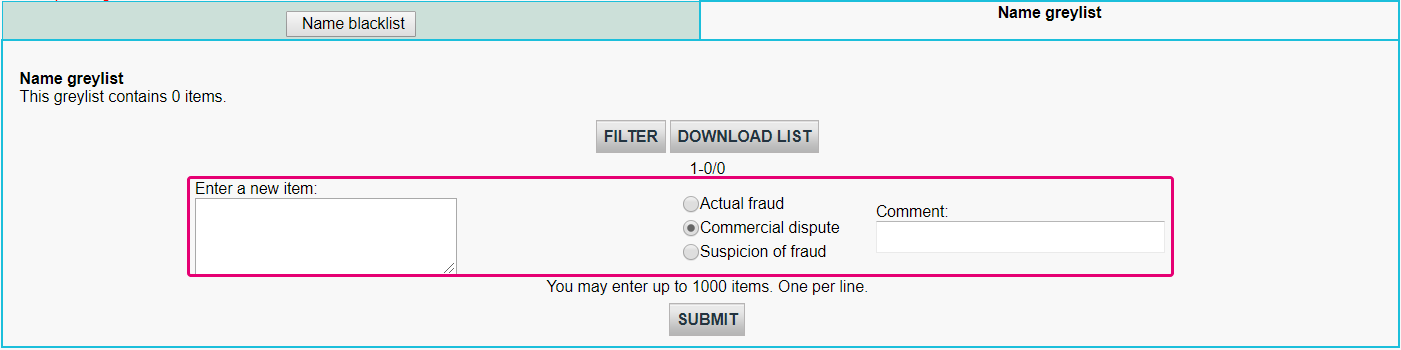

If you would like to add items to one of the list types above, select the respective list type and click EDIT.

To add items to a list,

- Enter data in the Enter the item

- Select either Actual Fraud / Commercial Dispute / Suspicion of Fraud.

- Optional: Add some information in the Comment field if you have any.

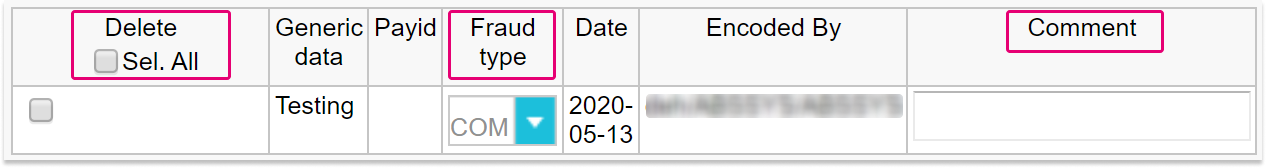

Manage existing list items

If you would like to manage items in a list, you can either:

- Delete: Remove one or more items by flagging All

- Fraud type: Modify the original entry to FRA (Actual Fraud) / COM (Commercial Dispute) / SOF (Suspicion of Fraud).

- Comment:Delete or change the original comment of your item by clicking on "..."

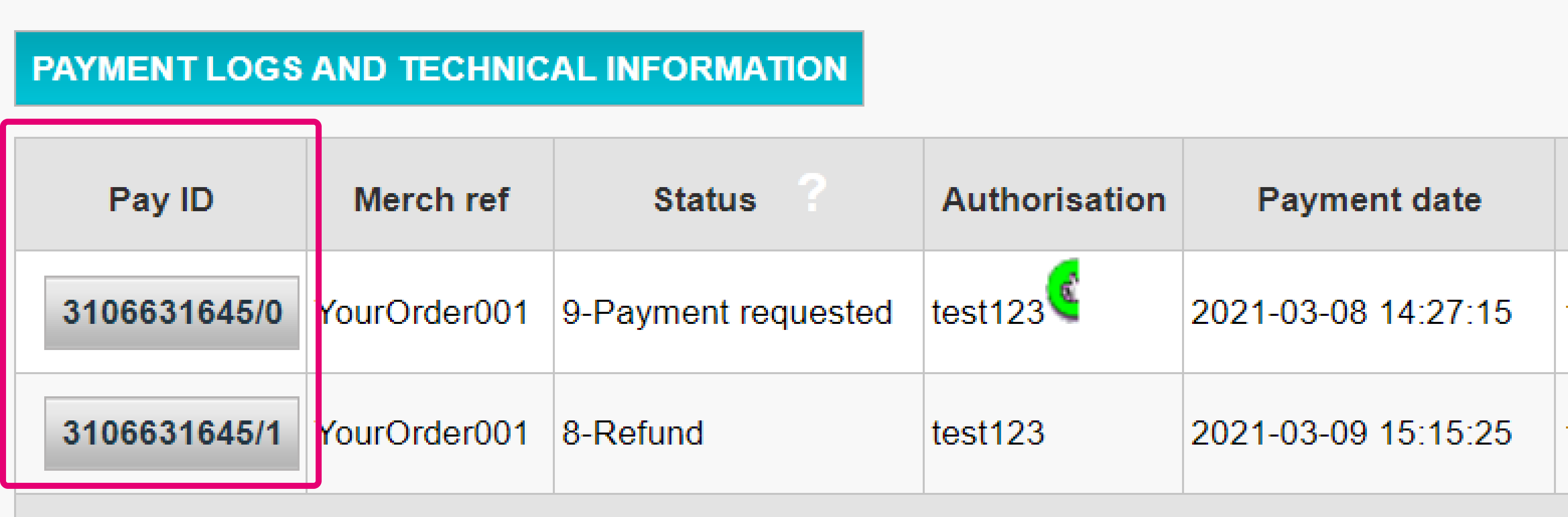

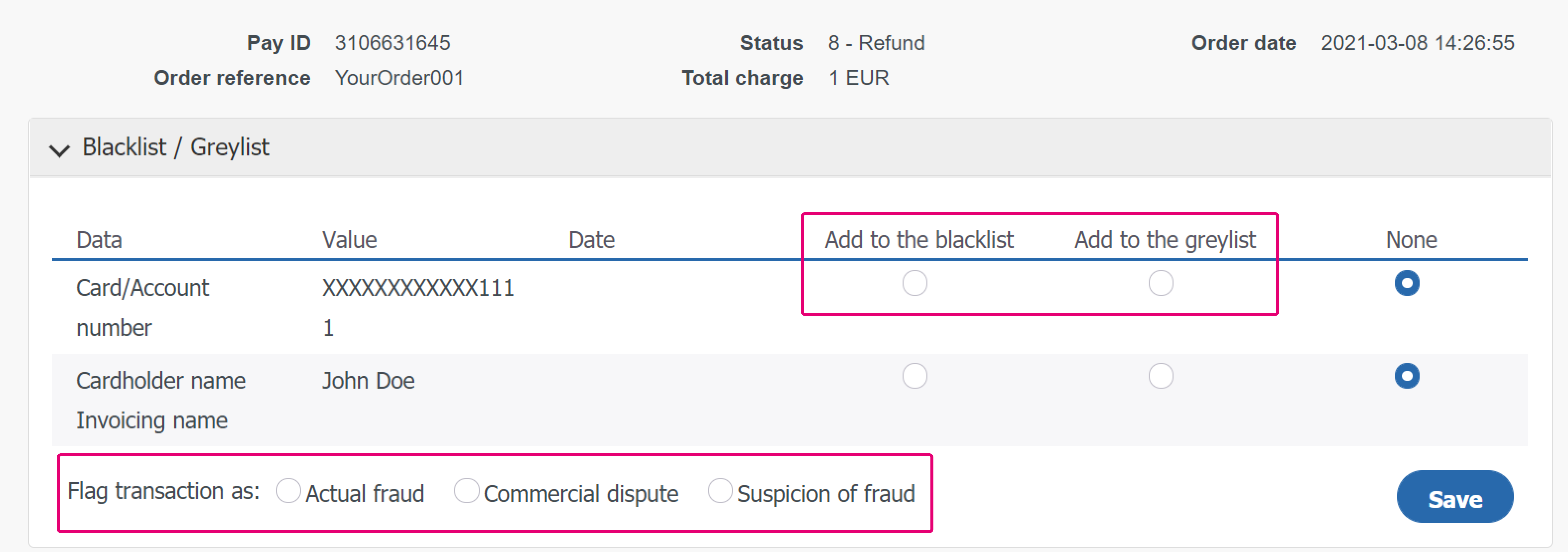

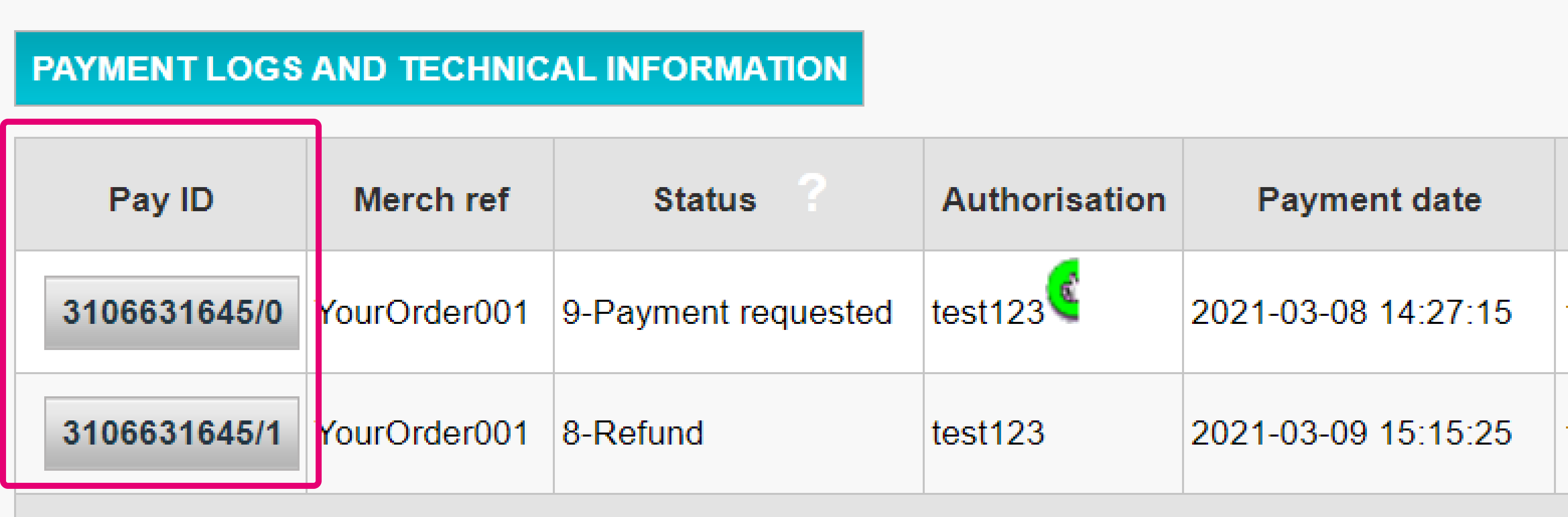

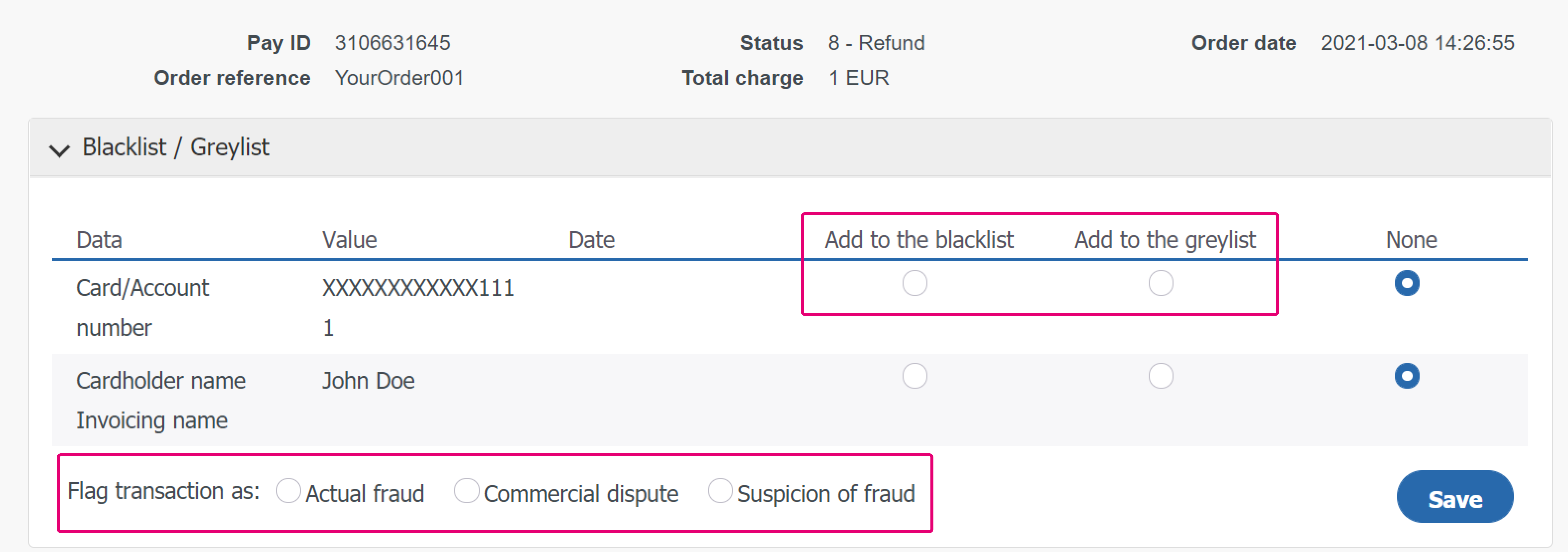

Our platform also allows you to put already processed transactions to this list. To do so, follow these steps:

- Log in to the Back Office. Go to Operations > View transactions and look up the transaction

- In the table displaying all maintenance operations for this transaction, click on any Pay ID button

- On the maintenance operation overview page, click on the “DISPUTE” button

- In the table, select either “Add to the blacklist” / “Add to the greylist” for any of the selectable transaction parameters. Flag then transaction as either "Actual fraud” / “Commercial dispute" / "Suspicion of fraud". Confirm your selection by clicking on the "Save" button

5. Manage fraud detection rules

With fraud detection rules, you can set purchase amount limits for transactions that go through your webshop. This chapter will teach you how you can set and manage these rules in your account.

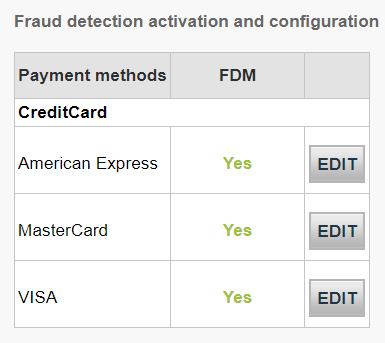

Go to Advanced > Fraud Detection. Under Fraud detection activation and configuration, choose a payment method that you would like to configure by clicking on EDIT.

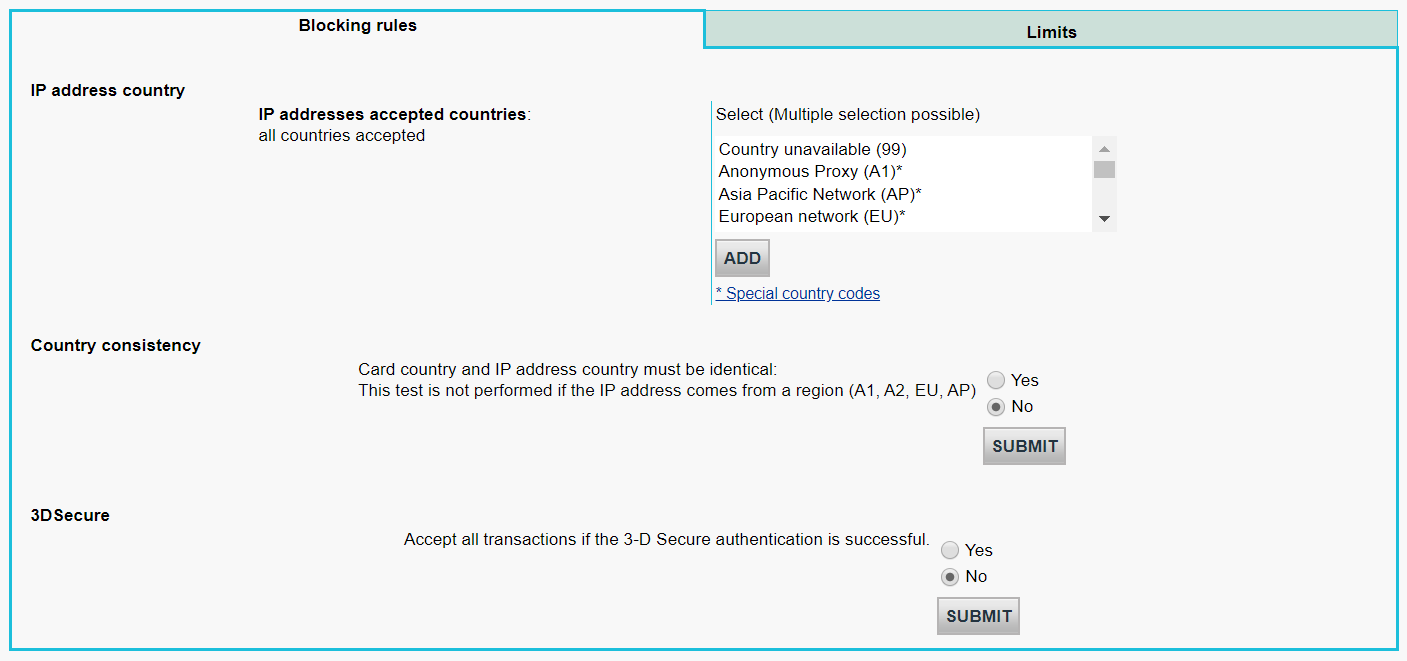

On the page, you will be able to define blocking rules and limits. Depending on your blocking rules and limits, you may need to send additional parameters to our platform.

Configure limits

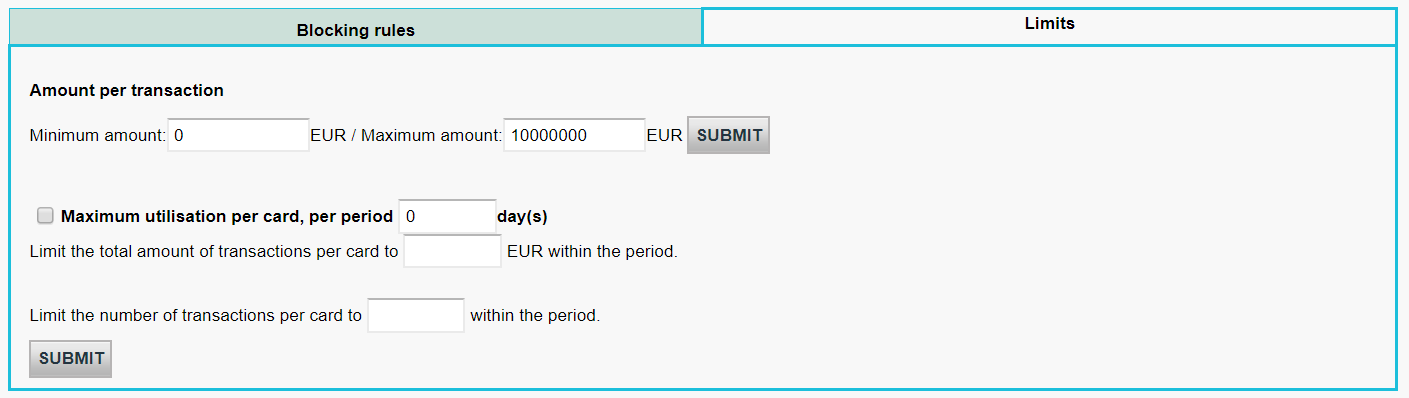

View the limits by clicking on the Limits tab.

Below is an overview of the limits that you can configure and what they mean.

| Limits | Explanation |

|---|---|

|

Limit the minimum and/or maximum amount that can be spent per transaction |

Transactions that go above or below these limits will not be accepted. |

|

Limit the total amount in EUR that can be spent per card within a period defined by you. |

Card usage limit is based on the number of successful transactions during the defined period. |

|

Limit the total amount of transactions that can be made within a period defined by you. |

Card usage limit is based on the cumulative amount during the defined period. |

FAQs

3-D Secure is a way to authenticate online transactions, similar to enter a PIN code or writing a signature for a transaction on a physical terminal in a shop or restaurant. It was initially developed by VISA under the name "Verified by VISA" and was soon adopted by MasterCard (SecureCode), JCB (J/Secure) and American Express (Safekey®).

There are several forms of 3-D Secure authentication. Depending on the customer's bank and originating country, it can be using a card reader or digipass, entering a PIN-code, or entering a piece of data that only the cardholder can know. 3-D Secure allows merchants selling online to verify that their customers are the genuine cardholder in order to reduce instances of fraud.

Nexi Payengine offers a complete suite of flexible products, sophisticated technologies and dedicated expertise to help you manage and optimize your online fraud prevention practices. Our industry-leading fraud detection tools and experts bring over 20 years of industry and regional expertise, and we will work closely with you to develop, implement and manage a holistic fraud solution that includes prevention, detection and management. We also offer comprehensive chargeback management and dispute management solutions.

By working with Nexi Payengine, you can pick the solutions that best fit your needs and customize our services to either outsource fraud management functionalities or keep them in-house with our ongoing support.